Our Offices: Philadelphia, PA Moorestown, NJ

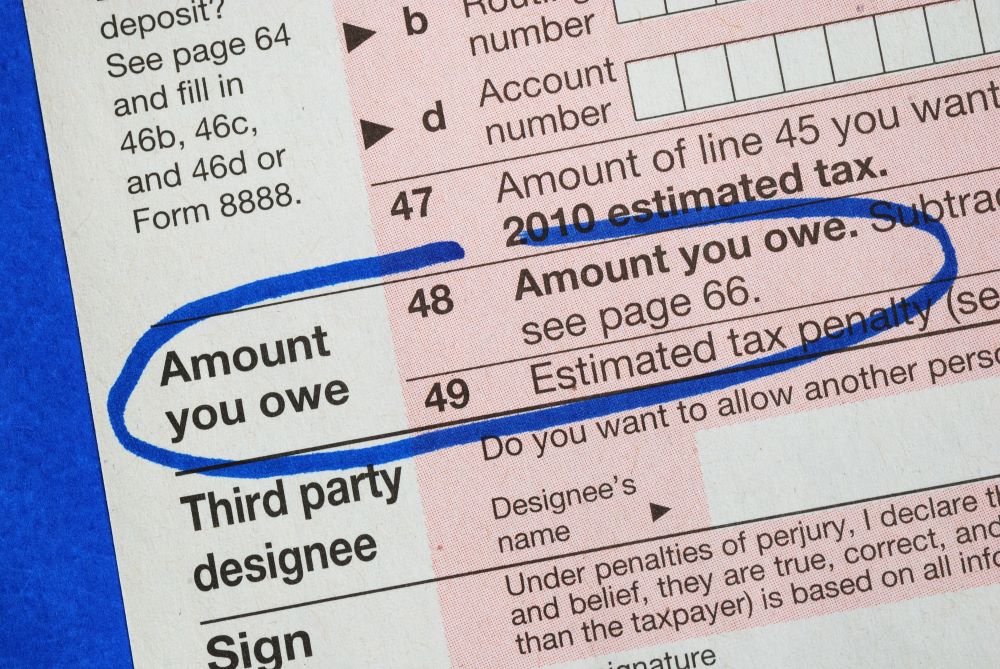

As an attempt to minimize the stress and financial burden on the U.S. taxpayers and small business owners during these trying times, the Federal Government is allowing individuals and businesses to delay paying their 2019 tax bills for three months. The goal is to inject up to $300B into the economy to avoid a recession. Individuals may delay paying up to $1M and corporations may defer up to $10M.

This change to deferred payment still requires you to submit your taxes on time!

The good news is that contrary to previous tax years you will not incur interest or penalties on deferred tax payments.

There have been some discussions around not offering this opportunity to the super-rich, which has not been defined to this point. The IRS is expected to release specific guidelines about how the program will work shortly.

It is hoped that with this delay in sending dollars to the IRS coupled with the economic stimulus package currently being negotiated in Congress, individuals and small business owners may use their hard-earned money in the short term to meet household budget and business needs.

The attorneys at Leonard Sciolla stand ready to help you with your tax questions, estate planning needs, and business issues. Check out our new virtual service offerings where you get the same quality expertise you’ve come to expect from us delivered in a way that keeps us all safer in today’s trying times.

Updates:

- On March 20th, the White House announced Friday that the deadline to file taxes has also been extended 90 days to July 15th

- On March 21st, the Pennsylvania Department of Revenue extended the deadline to July 15th

- On April 1st, New Jersey Governor Phil Murphy announced a July 15th deadline for New Jersey residents