Our Offices: Philadelphia, PA Moorestown, NJ

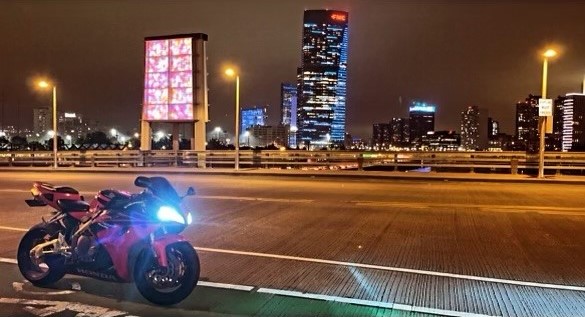

As we all know, it’s that time of year when motorcycles get on the road. As the weather warms up, it’s time to check your insurance coverage and be ready in case the worst happens. In this post, we talk about Uninsured/Underinsured Coverage and what to look for. You can also check out our previous post on tort status, and please be sure to keep an eye out for updates to this series.

Uninsured/Underinsured Motorist Coverage (UM/UIM)

Uninsured coverage applies when you are struck by someone who either doesn’t have insurance, or someone who leaves the scene before you can identify them. In that case, your own uninsured motorist coverage steps in and that’s where your recovery comes from. Whatever amount you elect as your uninsured coverage will be the limit of your recovery.

Underinsured, as the name implies, kicks in when the negligent driver that caused your injuries has insurance, but it’s not enough insurance to compensate you. In PA and NJ, the minimum policy a driver can have is $15k/$30k. In the event you are hit by someone with just a $15k/$30k policy, the most you can recover is $15k. If you have passengers, your group can collect up to $30k, but no one person will recover more than $15k. If you or your family’s damages total more than the other driver’s coverage limits, your underinsured coverage comes in to cover the difference. Like uninsured coverage, your recovery will be limited to the amount you select in your underinsured coverage.

If you’ve been in an accident, contact the dependable, experienced, and effective attorneys at Leonard Sciolla today.