By Leonard Sciolla, LLP | Published February 4, 2020 | Posted in Immigration, real estate | Comments Off on Buying a Home in the United States as a Non-U.S. Citizen

Search Site

Our Offices: Philadelphia, PA Moorestown, NJ

Call to schedule an appointment

215.567.1530856.273.6679

Category Archive

real estate

1 - 7 of 7

Page 1 of 1

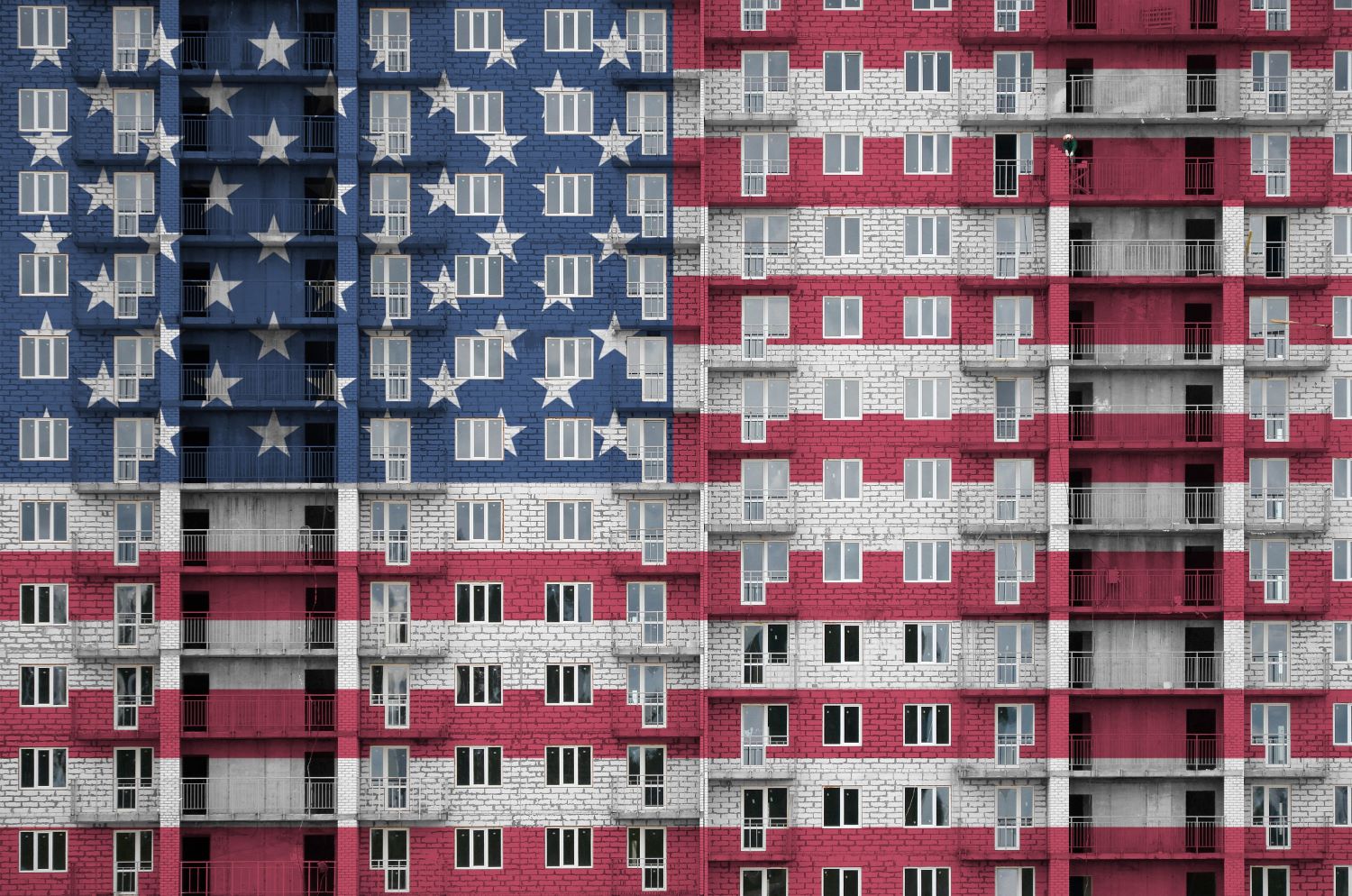

Buying a Home in the United States as a Non-U.S. Citizen

In the United States, anyone may buy and own property regardless of citizenship. But while many foreigners own permanent properties, vacation homes and/or investment properties in the states, the rules of buying and selling can be tricky. Purchasing property is easiest for foreign buyers who hold a green card, work visa, or other document proving Read More

Read More

Real Estate Law

From transactions to litigation, real estate matters can be some of the most stressful and costly endeavors in which individuals or businesses engage. Even a “standard” real estate transaction can be confusing to review. Having an experienced real estate attorney looking out for your best interests can relieve that stress and protect you from great Read More

Read More

A Case Against Inter Vivos Transfers

Proceed with caution when considering an inter vivos transfer of your home or property to a child or loved one: the consequences can be critical. Some people choose to transfer the title of their home to their child during their life instead of leaving it to their child in a will. The parent then continues Read More

Read MoreTax Amnesty Program

If you failed to pay real estate taxes, corporate taxes, or inheritance and estate taxes prior to December 31, 2015, the Pennsylvania Department of Revenue (“PA DOR”) is giving you the chance to do so under its Tax Amnesty Program. The Amnesty programs runs between April 21, 2017 and June 19, 2017. During that time, Read More

Read MorePhiladelphia Transfer Tax Rate to Increase

The real estate transfer tax Philadelphia will to increase from 3% to 3.1% on January 1, 2017. The tax, collected by the city any time real estate is sold, is added to the 1% collected by the state of Pennsylvania. That means as of January 1, the total transfer tax will be 4.1%. The local Read More

Read More

1 - 7 of 7

Page 1 of 1

Contact us